Content

The prices listed in this article do not include any discounts. You can check the company’s website to see current offers. TurboTax will pay IRS penalties and fees related to calculation errors. If it’s determined that you entered information improperly, the guarantee does not apply. Option to upgrade for live support.Pay extra and you can talk to an expert at any time in just a few clicks, or hand off your documents to a professional who can do everything for you. Guidance for important tax forms.TurboTax tells you what you need to enter to do your taxes based on your unique circumstances.

How much does TurboTax charge to file an amended return?

No. If you need to amend your tax return in TurboTax, there is no additional fee.

For tax purposes, your adjusted gross income or AGI is essentially your total or gross income minus eligible deductions. You can use ourAGI calculatorto estimate your adjusted gross income using the most common income and deductions for US taxpayers. The purpose of tax deductions is to decrease your taxable income, which then decreases the amount of taxes you need to pay to the federal government. To help you reduce your taxable income, we aggregated ahuge list of deductionsmany people often overlook or aren’t sure how to use them to their advantage. Use of the Calculator is subject to the restrictions found in our TaxActLicense Agreement and our Privacy Policy. Prior year returns can only be filed electronically by registered tax preparers for the two previous tax years.

Tax Talk

Melanie Pinola previously covered all things home office as a senior staff writer at Wirecutter. She has contributed to print and online publications such as The New York Times, Lifehacker, and PCWorld, specializing in tech, productivity, and lifestyle/family topics. She’s thrilled when those topics intersect—and when she gets to write about them in her PJs. H&R Block’s summary screens act like milestones within the tax-preparation process. TurboTax’s explanations may not seem revelatory, but they can help to assure you that you’re filing correctly and potentially catch typos or glitches. However, it’s possible to get it for free if you file by March 31.

- You’re eligible to apply through Credit Karma Money if your TransUnion credit score is 619 or below at the time of application.

- When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology.

- It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation.

- In other words, a tax specialist takes a look at the contents of the return to check for possible errors or omissions.

- Pet Insurance Best Pet Insurance Companies Get transparent information on what to expect with each pet insurance company.

- More self-employed deductions based on the median amount of expenses found by TurboTax Premium customers who synced accounts, imported and categorized transactions compared to manual entry.

This makes the process of filing your taxes generally seamless — the program never drops the curtain between you and the IRS forms. You simply answer questions and your return gets filled in behind the scenes. For simple tax returns only; it allows you to file a 1040 and a state return for free, but you can’t itemize or file schedules 2 or 3 of the 1040. If you used IRS Free File last year, you will receive an email from the same company that you used, welcoming you back to their official IRS Free File services. The email must include a link to the company’s IRS Free File site and explain how to file with it.

H&R Block do-it-yourself options

There is one exception to this recommendation, though. If you have a simple return and student loan interest or tuition payments, you should file using H&R Block Free Online instead. TurboTax Free Edition doesn’t let you file the forms related to interest deductions and educational credits, so it will prompt you to upgrade to Deluxe. Free tax expert help is available at TurboTax through the end of March for some users. For those who qualify for a simple tax return, users can take advantage of TurboTax’s Live Assisted Basic for help with their return. With H&R Block, assistance from a tax professional starts at $70.

- Lastly, MyFreeTaxes says TaxSlayer offers chat, email, and phone support.

- In return, the IRS agreed it would not create its own tax filing system that could compete with the tax prep companies.

- Bookkeeping Let a professional handle your small business’ books.

- TurboTax Live Assisted lets you regularly consult with a tax expert who will review your return before you submit it.

- We guarantee your maximum Tax Refund or the least amount of Taxes due based on the information you entered.

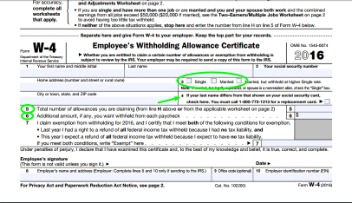

- In addition to answering these questions, you’ll need to add information from your employer, other income sources, and 1099, 1098, W-2, and other tax forms that may show up in your mailbox or inbox.

Note that the IRS will never call or email you demanding payment or access to your account. (The IRS will almost never email you at all, in fact, so do not click any link in an email that appears to be from the IRS.) Do not give out passwords or other details over the phone. If your taxes won’t be done by this date, you’ll need to file an extension with the IRS. However, the agency has offered an automatic extension until May 15 to qualifying storm victims in Alabama, California and Georgia. H&R Block has locations across the US, and you could get in-person help with your taxes in addition to the option of online support. While in-person support isn’t free with the purchase of a tax package, it could be helpful for those who want it.

H&R Block Free Online

It’s a bit harder to read the additional information given the smaller screen, but you can still follow along with TurboTax’s interview-based approach on a limited interface. Most advantageous, however, is the additional information that’s provided to help you answer your difficult tax questions with simple responses and expanded context. You can delve as deep as you like to resolve a tax matter, depending on what your needs are and how much time you have. To maximize their deductions and report personal and business income and expenses, along with investment income and rental property income.

- Again, TurboTax guarantees this review, or it’ll cover your costs.

- For those with itemized deductions, rental property income, or business income, it could cost less to use H&R Block than TurboTax.

- But since the experience can be highly variable depending on the chat agent you’re assigned, we hesitate to make it a blanket recommendation.

- We have official accounts for ProPublica on Twitter, Facebook and Instagram.

- If you receive a larger refund with another app or a smaller tax burden, you will get your federal and state filing fee back.

- We earn a commission from affiliate partners on many offers and links.

Like TurboTax, H&R Block uses its interview prompts to guide you to the appropriate forms, but it sometimes doesn’t assign all of the right ones. For example, even though our fake filer had medical expenses that qualified them for the itemized deduction, H&R Block didn’t direct us to the Schedule A form to itemize their expenses. We had to scroll to the bottom of the page, select “Add deduction,” and track down the appropriate form. For this reason, we recommend always manually reviewing the list of form choices before confirming you’re finished with each section of your return. We decided to leave the fictional filer to consult their fictional tax professional instead. Kaitlyn Wells is a senior staff writer covering the intersection of home office, productivity, and technology.

If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. If you want someone to represent you in front of the IRS, you’ll need TurboTax’s audit defense product, called MAX. It runs an extra $49 and includes features such as identity theft monitoring, loss insurance and restoration help. TurboTax Digital Assistant and contact form available for all; paid packages get access to a TurboTax specialist.

TurboTax’s range of filing options caters to different financial situations, whether you’re single, married, a homeowner or self-employed. There are extensive features included with each plan to maximize efficiency and transparency. It’s easy to import information and there are explanations of why and how refunds fluctuate. There are also tax calculators, a tips section and access to other services, like QuickBooks. All in all, TurboTax is very user-friendly and does a great job of simplifying tax season.

The standard deduction is a set amount based on your filing status. Itemized deductions are ones you can claim based on your yearly expenses. It makes sense to choose whichever turbo tax income tax estimator will yield you the greatest tax break, but if you choose to itemize deductions, you’ll need to keep track of your expenses and have receipts or documentation ready.