This amount will come after deducting the entity’s liabilities from its assets. In banking, the term account balance refers to the overall funds available in a financial account. As mentioned, businesses, companies, and individuals use bank accounts to facilitate transactions. For example, an economy decides that it needs to invest for the future to receive investment income in the long run. Instead of saving, it sends the money abroad into an investment project. Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks.

Investment cycle, financing cycle, operating cycle and cash flow cycle

To increase a liability account, it is credited; to decrease it, it is debited. Total debits amounted to $40,000 while total credits is equal to $110,000. In the above account receivable ledger, the debit side includes increases in the account balance. Overall, the $250,000 remaining balance represents the difference between both sides. Therefore, the account balance shows the residual amount after deducting the credit balances from the debits. Practicing responsible spending habits, such as avoiding impulse purchases and living within your means, can help maintain healthy account balances and reduce financial stress.

Bank Account

Many banks have policies that release some of the funds from large check deposits immediately, but require the customer to wait a few days before they can withdraw the rest of the amount. This lets the bank confirm the check’s validity with the check writer’s bank. Let us understand the concept of bank account balance in depth with the help of a few examples. These examples would give us a practical viewpoint to understand the concept. Furthermore, it’s much easier to begin and grow your funds in a savings account with peace of mind knowing that you’ll be earning interest on your balance.

How is the functional balance sheet analysed?

- In accounting, the easiest way to find an account balance is by printing the trial balance report for the current accounting period.

- People generally conduct multiple transactions in these accounts, adding and removing money at various times.

- Instead of representing the cash to spend, it will refer to the amount payable by the entity to the bank.

- Account balances in accounting are a part of a company’s Statement of Financial Position.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

It is also helpful to pay attention to the footnotes in the balance sheets to check what accounting systems are being used and to look out for red flags. The data and information included in a balance sheet can sometimes be manipulated by management in order to present a more favorable financial position for the company. The balance sheet only reports the financial position of a company at a specific point in time.

What is an Account Balance in Banking?

For instance, if a company takes out a ten-year, $8,000 loan from a bank, the assets of the company will increase by $8,000. Its liabilities will also increase by $8,000, balancing the two sides of the accounting equation. In order to see the direction of a company, you will need to look at balance sheets over a time period of months or years. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. The current account is calculated by finding the balance of trade and adding it to net earnings from abroad and net transfer payments.

Use of Account Balances

A price target is when an analyst creates a forecast of the future price of a security (tradable financial asset) based on historical and projected earnings. Now, consider a scenario where the fund has a share price of $1, and you can purchase 5,000 shares with your $5,000 investment. If the share price increases to $1.01, your investment would be worth $5,050, resulting in a 1% return on investment.

People generally conduct multiple transactions in these accounts, adding and removing money at various times. The opposite is true when the total credit exceeds total debits, the account indicates a credit balance. If the debit/credit totals are equal, the balances are considered zeroed out. In an accounting period, “balance” reflects the net value of assets and liabilities to better understand balance in the accounting equation. Account and statement balances are similar in representing the total amount of money in an account. However, statement balance refers to the balance reflected on a bank statement, typically generated at the end of a billing cycle or a specific period.

So whether you need to write a check, deposit cash, withdraw funds, or simply check your current balance, a money market account has covered you. Plus, you can make the most of your money with the added perk of earning interest on your savings. With a few clicks, a user can access definition of account balance different accounts and their account balances. Getting the account balance – whether done manually or automated through a computer, involves the same process. The account balance is equal to the difference between the total amount debited and the total amount credited.

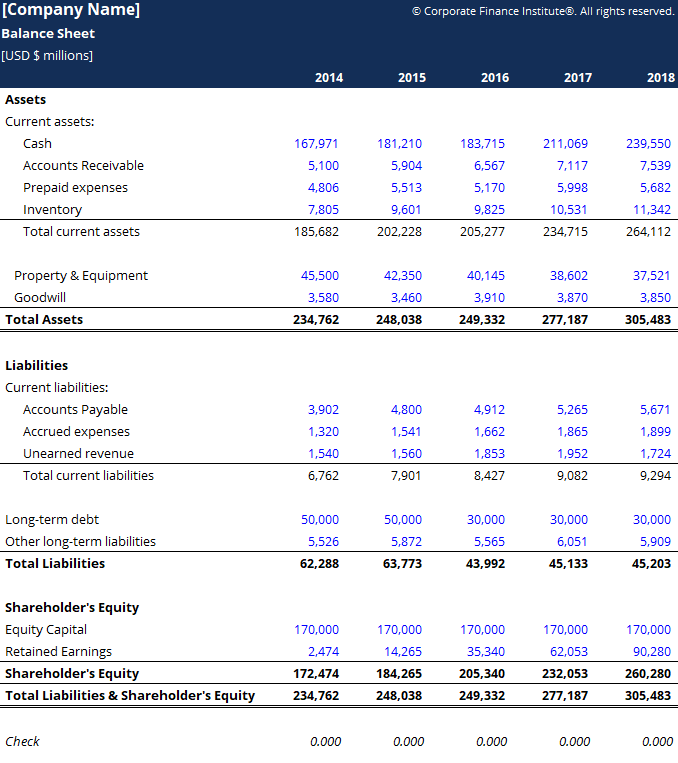

Depending on the company, different parties may be responsible for preparing the balance sheet. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. For mid-size private firms, they might be prepared internally and then looked over by an external accountant. The image below is an example of a comparative balance sheet of Apple, Inc.

Most brick and mortar banks offer online banking services or apps that allow customers to log in from their phone and check their balance. Some people who have accounts at different institutions may use a financial tracking software to keep track of their balances across multiple accounts. Account balance refers to the total amount of money in an account at a specific point in time, including all deposits, withdrawals, and other transactions. Available balance, on the other hand, refers to the amount of money that is immediately accessible or usable for transactions, taking into consideration any holds, pending transactions, or restrictions. A savings account is an excellent choice for new investors who seek a safe financial option that complements their checking account. While interest growth is typically slower than other account options, this account functions similarly to a checking account and offers hassle-free electronic money transfers between accounts.

You can use a scale to weigh things, like food or liquid that you want to cook with. The reading on the scale increases as you add things to it, and decreases as you take things off. Similarly, an account’s balance rises and falls as you deposit and withdraw money from it over time. In banking and accounting, the balance is the amount of money owed (or due) on an account. Conducting an account balance check is not only important but also a necessity in times when cyber fraud and cyber hacking are on the rise. It is also important to keep in mind that most banks expect a minimum amount to be in the individual or a company’s repository at all times.